Consumption of household appliances: November closed with a growth of 6% year-on-year

The report highlights that Cyber continued to consolidate as a key driver of consumption, especially in technology and durable products.

GfK, a NielsenIQ (NIQ) company, a global leader in market intelligence, shares the most notable results of November 2024, a month marked by the impact of Cyber, one of the most anticipated commercial events of the year.

The data collected confirms that Cyber continued to consolidate itself as a key driver of consumption, especially in technology and durable products. Here are the main findings:

Increase in units sold and role of Cyber

· In November 2024, 1,897,000 units were sold, representing a recovery of 6% compared to the same month of the previous year.

· The Cyber event had a 35% impact on total sales, marking an increase of 3 percentage points compared to 2023.

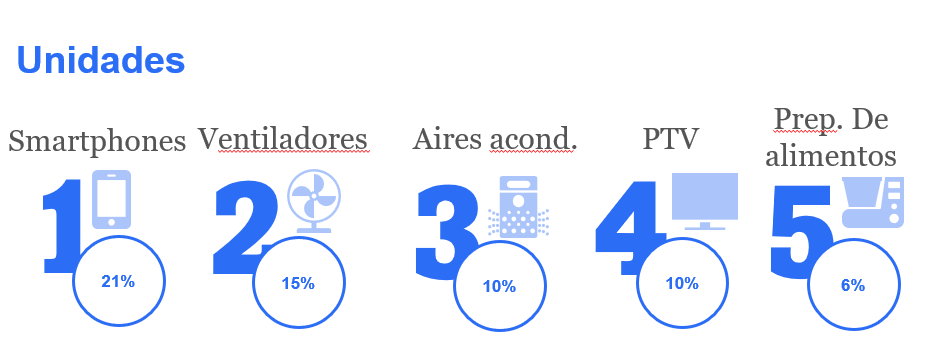

Market dynamics and featured categories

· The best-selling categories during November included smartphones (21%), fans (15%), air conditioners (10%), televisions (10%) and food preparation products (6%).

· Consumption reflected seasonal factors, with high demand for air conditioning products such as fans and air conditioners.

Market evolution in 2024

- Although 2024 registers a cumulative contraction of the 21% in units sold, November stood out for reaching a new mark of positive growth (August was another month with year-on-year growth, although lower, reaching 3.6%).

- Since July, the decline in contraction has been sustained, going from -33% average in the first half to -5% in the second half.

Changes in consumer behavior

- Consumers prioritized products based on value for money and the innovation. Examples include:

- Notebooks, driven by the introduction of more accessible brands.

- white line, with average prices rising below inflation.

- Coffee makers, driven by capsule and barista-style models.

- Shavers and epilators, aligned with new social trends of personal aesthetics.

The relevance of electronic commerce

- During Cyber, 60% of sales were made online, consolidating digital platforms as the main purchasing channel.

- Promotions and interest-free installment financing options were decisive factors for consumers.

Daniela Martínez, Head CSM Tech and Durables at GfK, commented: “The month of November marks a very positive recovery in consumption for the sector, with consolidation of online consumption driven by Cyber, which was the best edition of the last three years. Growth is observed mainly in categories crossed by two consumption dynamics: those marked according to value for money and those aligned with innovation. Within the first group, categories stand out in which more accessible brands were incorporated into the market (for example, notebooks) and in the second group, categories in which there are innovative products that boost consumption (an example is coffee machines with capsule and barista style models).”

Latest news

Outstanding sector