Change of the year: positive balance and good expectations throughout the sector

In our 171st edition, several market players analyze 2024 and projections towards 2025

After the first half of 2024 with adjustments in all markets, and the recovery that slowly began in the second, expectations are now set on the gradual increase in that recovery being sustained. Maintaining low inflation control, along with financing for consumption, are two pillars that established the beginning of the reactivation and something that both suppliers and merchants consider fundamental. We spoke with some of them and, in general, we collected expressions of optimism and desire that new conditions for the economy open opportunities to generate a greater variety of products on the supply side and new businesses in all sectors.

But we cannot forget the enormous fall that the economy had and that affected all sectors during the first months of 2024. We must remember it as learning, to continue producing and sustaining constructive changes and grow. It is useful, then, to start by taking into account the magnitude of the market decline and there is nothing better than listening to the protagonists.

“We started the year with a 50% drop, starting in the second quarter we already saw considerable improvements and in our case, we will end 2024 with a 25% increase in products compared to 2023, although those are not the market numbers”said Diego Petenatti, Director of Petenatti Hogar, citing figures that were similar for all, although with obvious differences due to the asymmetries that the sectors have and the prices of what they produce and market.

From Avelino, Martín Ferullo, its Director, recalled that together with a consulting firm they had predicted a 50% drop in consumption for the first quarter, which dropped to 25% in the second and 5% in the third. “It was like that, and at the beginning of this year, without touching the margins, sales fell and the first half of the year was at the expense of stock,” he added. “That reactivated a purchase other than that of 2023, with a non-speculative sale projection.”

“The 2024 numbers were in line with what we had forecast, a drop of between 35% and 40% during the first half but with a recovery in the second half,” said Piero Mastronardi CEO of Goldmund. "The dynamics of consumption from the middle of the year, with the appearance of financing and the stabilization of prices, attenuated the loss of the first semester and we believe that the year closes with a general drop of 20%, which is acceptable within expectations."

“The last few months have had some signs of recovery, although very slow,” said Fernando Peiretti, Retail Sponsor at On City. “We closed a year with many offers and promotions, but with a measured and very analytical consumer, who analyzes a lot before aggressively buying.”

Prices, the usual concern

We have an inflationary culture built for so many years that, inevitably, it leads us to begin analyzing the prices of any type of goods or services by calculating how much they increased. Ending that is the first impact that inflation control should have, and some of that appears to be happening. Petenatti considered that many of the adjustments that the Government made to the economy are having an impact, although without yet producing considerable losses. “What we are seeing now, as the months go by, is that there are no increases, and both in the businesses and in the operations that we are doing for the first half of 2025 we notice that prices are maintained”, he stated.

Perspectives: a clearer horizon

In general, all market players see 2025 as a positive year and there are arguments to support it. Nothing indicates that inflation cannot continue to be kept under control, the contraction in consumption due to fear was diluted as the months went by during the second part of 2024 and to the extent that the purchasing power of the population recovers, sales will surely improve.

“By 2025 we see a stable outlook, with growth close to 15% compared to 2024, although all this will be tied to the economic situation of the country and the investments we have planned”Petenatti said.

Looking at the year that has just started in perspective, Ferullo considered that it will begin with much less stock in the commercial channel and predicted a reactivated first quarter compared to the first of last year. “If interest rates and costs continue to fall, the beneficiary of all this will, without a doubt, be the consumer.”, broad.

For the first half of 2025, Mastronardi forecast a level of activity similar to that of the last months of 2024, but with a significant recovery over the same period last year. “In categories like the ones we work in, where the purchasing decision is not complex, there is already a better dynamic that will be maintained,” said.

“We see a first half of 2025 that will continue to grow, but slowly,” said Peiretti. “We believe that we are going towards great growth because of how low 2024 was. It will not be pronounced growth, but the curve of the last quarter of last year will continue.”

A better year, but very competitive

Just as everyone was generally optimistic about the outcome of the coming months, no one doubts that they will be highly competitive. Something that should not scare anyone, because you compete well only with parity of opportunities, and that is what allows a stable economy.

Petenatti maintained that to the extent that As the income of the population adjusts, demand should improve. With the lowering of rates and the 12 quotas we are already beginning to see a clearer picture, but with the opening and imports of products, 2025 is going to be a highly competitive year and whoever works best and best adapts to the changes that occur will have a better result.”

“Our challenge is going to be to offer retail competitive businesses and continue lowering costs,” said Ferullo. "We had become accustomed to having a very low supply of products and I think that the greater variety of options for the consumer will quickly be felt. What we will try to do with whoever wants to import our products is that we Leave that management to us for a very low difference and point those guns at other businesses. Services will have to be offered. In the market where we are going, 5 points are going to make a difference.

“We have some uncertainty about seasonal products, due to the elasticity of demand due to the weather,” said Mastronardi. "We believe that there will be greater supply, in some cases even exaggerated and with some drop in margins, but we also foresee an opportunity for Peabody to venture into new categories, and this scenario is going to give us a positive result."

Peiretti expressed good expectations due to the drop in inflation, the interest rate and the opening of imports, which, he stated, will allow for a greater variety and quantity of products. “The greatest urgency is to see how we compete with the gray market, products that enter and are sold on online platforms or local businesses without paying taxes, through informal channels,” he said, adding that the consumer no longer only chooses by price but also by service, attention and experience. “Those who provide this will be the ones who stand out,” he concluded. "Immediate deliveries, offers, the variety of products to choose from and financing will be key. In short, ultra-personalization in dealing with the customer so that the brand is superior and memorable."

Cyberweek 2024: testimony of improvement

We are beginning to go through a year that, even with this panorama, is not free of challenges. On the part of the macroeconomy, which we do not manage on a day-to-day basis, structural reforms are pending that sustain in the medium and long term the achievements that are seen today in the microeconomy. But there are relevant data that we do see and we take the recent Cyber Week as an example.

According to GfK, a NielsenIQ company, 730,000 units were sold at Cyber Week in November 2024, an increase of 12% compared to the same event in 2023 and 154% compared to the previous week. 346 billion pesos in billing were reached, which represents a growth of 185% compared to Cyber Week 2023 and an increase of 195% compared to the previous week. The online channel grew by 18% in unit sales compared to the 2023 event and 430% in billing compared to the previous week, while the offline channel increased by 6% compared to Cyber Week 2023 in unit sales and 61% compared to the previous week. The growth of the online channel shows the installation of omnichannel and a maturity of the consumer that adapts to changes and uses all resources to optimize their purchases. Distribution channels have already taken this into account when diversifying the forms of their offer. We are coming out of a complicated year, with adjustments in all sectors but which leaves open a much better perspective than the one we had at the beginning of 2024. Work and a clear direction have to be the tools so that each one has the development they need.

Consumption in 2024

A recovery outlook and also transformation

The consumption recovered in the second half of last year is the best indicator of the continuity of that recovery this year.

By Milagros Bin

Customer Success Retail Manager de NielsenIQ

Ehe home appliance and technology market has experienced a challenging 2024, with a cumulative drop in units sold. Without However, November stood out as a key month for recovery, with year-on-year growth driven, in large part, by the Cyber event. This phenomenon shows how the Argentine consumer is adapting their purchasing habits in a changing economic context, prioritizing both convenience and the added value of products.

The Technology and Durables (T&D) market fell 17.3% in 2024, showing different behaviors depending on the semester. The first semester showed a drop of -32.9%, with the first four months of the year being the hardest, with drops of around 40%. It is worth noting that, if we review the first half of 2023, it grew by 5%. The photo of the second half of 2024 is very different, since the market showed a recovery of 0.5% versus 2023, when the sector began to show negative results starting in September. Furthermore, December 2024 showed 40% growth, and this trend appears to continue in January, with the top four weeks of the year registering positive variations, all above 35%.

Data from GfK, a NielsenIQ (NIQ) company, reflects that Cyber has established e-commerce as a key channel, underscoring the growing importance of promotional strategies and financing options. The improvement in consumer confidence and the greater inclination towards planned purchases have been decisive in this growth. Consumer behavior was marked by the demand for seasonal products and the preference for categories that offer innovation price accessibility. Among the best-selling products, smartphones, fans, air conditioners and televisions stood out. Growth was also observed in notebooks, driven by the introduction of more accessible brands, and in capsule coffee makers and shavers aligned with new personal aesthetic trends.

Digital commerce continues to gain ground, and Cyber has proven to be a fundamental platform to encourage consumption. Promotions and payment options in installments have been key to the growth of the sector. This behavior also reflects a change in the way consumers research and purchase products, with greater confidence in online shopping. Accessibility and the possibility of comparing prices have driven the digitalization of the home appliance market. Although the year began with a significant drop, since the second half of the year the contraction has slowed, reinforcing the importance of commercial events such as Cyber and the market's ability to adapt to new consumer conditions. By 2025, the challenge will be to continue this recovery and strengthen the relationship with an increasingly demanding, informed and value-for-money consumer. The key for the industry will be to continue innovating in products and commercial strategies that align with this new market reality.

Smartphones

From growth in 2024 to the challenges of 2025

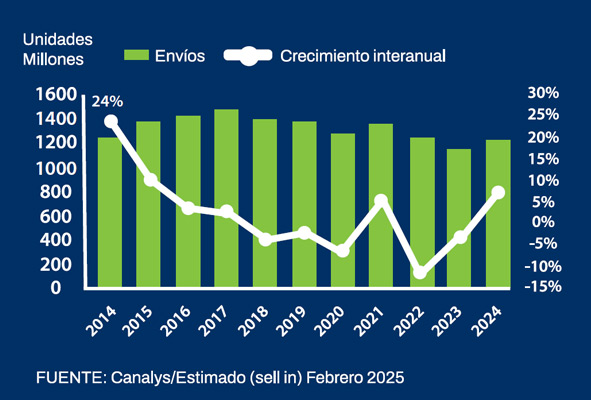

According to analysts from the consulting firm Canalys, after a 2024 with growth, this year global players will prioritize the average sales price, profitability and diversification of their portfolios.

According to the latest Canalys research, The global smartphone market grew by 7% in 2024, reaching 1,220 millionnes of units, which marks a rebound after two consecutive years of declines. iPhone shipments decreased 1% to 225.9 million units; Samsung followed closely, with shipments falling 1% to 222.9 million units; Xiaomi remained in third place with strong momentum in mainland China, strategic expansion in emerging markets and shipments that grew 15%, to 168.6 million units; TRANSSION took fourth place for the first time and OPPO (including OnePlus) rounded out the top five with growth of 15% and 3% to 106.7 and 103.6 million units, respectively.

According to Canalys analyst Runar Bjorhovde, 2024 was a year of recovery for the smartphone industry, with the highest annual volume of global shipments after the pandemic. “Demand skyrocketed in the mass market segment, driven by a renewal cycle of smartphones purchased during the pandemic along with channel replenishment,” he added. “Several suppliers took advantage of this trend, targeting the open market channel and leading with products focused on a strong relationship between quality and price. However, the focus on increasing volume carried a risk of margin erosion to keep prices competitive. To counter this, and manage profitability, suppliers reduced fixed costs and optimized their resource planning. Beyond solid growth in emerging markets, mature economies began to recover, including growth in mainland China at 4%, North America at 1% and Europe at 3%. Demand in these regions has accelerated due to major supplier promotions, such as discounts, exchanges and device packages, used throughout the channel.”

“Sellers face a difficult 2025, with increasing complexities globally and regionally,” Bjorhovde added. “Emerging markets were the sector's growth engine in 2024, but growth has slowed as some markets are reaching a saturation point. Finding the right balance between short-term performance, inventory management and long-term investments will be key for sellers to be successful in these markets.

Economic fluctuations, potential US tariffs and compliance requirements add unpredictability to the market. But rising premium trends, mainland China's subsidy scheme and evolving financing models offer growth potential. In 2025, sellers will prioritize ASP (average selling price) growth and profitability, and strengthen their presence through diversified product portfolios, brand-driven marketing and greater channel collaboration. The ability to overcome these challenges and take advantage of emerging opportunities will define the leaders of the next phase of the sector's evolution.”

Latest news

Outstanding sector