The SME industry rose 3.4% annually in April

The production of the SME manufacturing industry rose 3.4% annually in April, at constant prices, and had a decline of 0.5% in the monthly comparison [...]

The production of the SME manufacturing industry rose 3.4% annually in April, at constant prices, and had a decline of 0.5% in the monthly comparison (against March).

The use of installed capacity of the companies in the sample was 70.4%, 1.2 percentage points below March, with the highest levels in Textile and Clothing (75.8%) and the lowest in Food and Beverages (68%).

Production orders remained firm during the month, but companies had greater difficulties than usual in producing due to delayed deliveries of raw materials.

In April, the industry did not have demand problems because the market was very dynamic, but it did have production problems due to the increase in prices and shortages of inputs.

Qualitative data

62% of the SMEs consulted evaluated the current situation of their company as good or very good, 1.4 points above March.

In turn, 61.0% of the companies in the sample worked with positive profits (vs. 61.5% in March).

Regarding expectations, for the next 2 months, 10% of industries expect their production to increase, 5% to decrease and 85% to remain unchanged.

Sector analysis

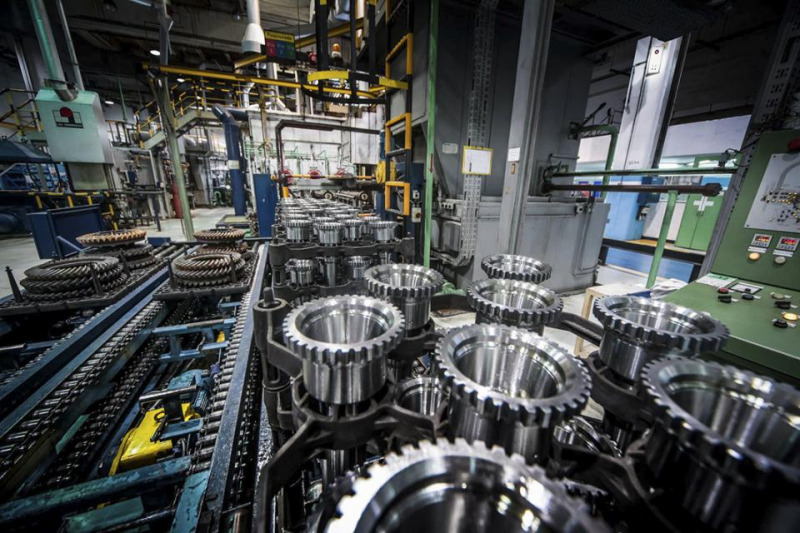

The best performance in April was in the industrial branch linked to the Manufacture of metal products, machinery, equipment and transport materials, with an annual increase of 11.6%. The worst happened in Wood and furniture with a new annual drop of 7.6%.

– Clothing and textile. Production rose 4.3% annually in April and fell 9.3% in the monthly comparison. Winter clothing production orders remained firm throughout the month and the sector worked with 75.8% of its facilities, which are relatively high levels. The sector is in a stage of renewal of machinery and incorporation of technology to supply the supply and particularly in April, it was faced with supply problems of some inputs, especially fabrics, threads and inks.

– Chemicals and plastics. Production fell 2.5% annually in April and 14.4% monthly. The use of installed capacity was 70.5%, 2.9 percentage points below March. The companies in the sector consulted agreed that demand is becoming more uncertain. At the same time, the activity has been having a complicated year due to the inflation in dollars of its inputs, which is affecting sales.

– Paper, cardboard, editing and printing. Production fell 0.9% annually in April and 0.9% monthly. But the use of installed capacity rose 0.8 percentage points, to 70.5%. For the publishing and printing subsector, they were active months due to the book fair, despite the fact that the move to digital has marked a trend of lower demand. Paper and cardboard production also moved well, especially in industrial-oriented sectors.

– Food and drinks: Production fell 0.2% annually in April and 5.5% monthly. We worked with 68% of the installed capacity, 5.1 points less than in March. The sector encountered greater problems in transferring cost increases to prices because demand did not maintain the firmness of previous months. School demand, the return of events or in-person work, which are factors that have been driving demand in areas such as pasta factories, cookie factories, bakery products, or beverages, were more sensitive to price increases in April and business owners had to absorb a part of it with their profitability.

– Metallic, machinery, equipment and transport material. Production rose 11.6% annually in April and 12.1% monthly. The sector is very active, driven by the greater investments that industry and agriculture have been making. Public works is another element that helps the good momentum of the activity. Likewise, the consulted manufacturers complain about the weekly price increases of their inputs and the uncertainty in deliveries by suppliers. In April, work was carried out with 69.8% of the installed capacity, 0.9 percentage points above March. According to the companies consulted, the lack of inputs and specialized labor is what today prevents further increases in production, not demand itself.

– Wood and Furniture. Production fell 7.1% annually in April and rose 6.9% monthly. Companies worked with 72.9% of their facilities, 1 percentage point above March. The sector noticed the difficulties in obtaining basic supplies such as glues or also the delays in deliveries of imported plates. In any case, demand was more active than in March and that contributed to improving expectations for the sector.

Latest news

Outstanding sector