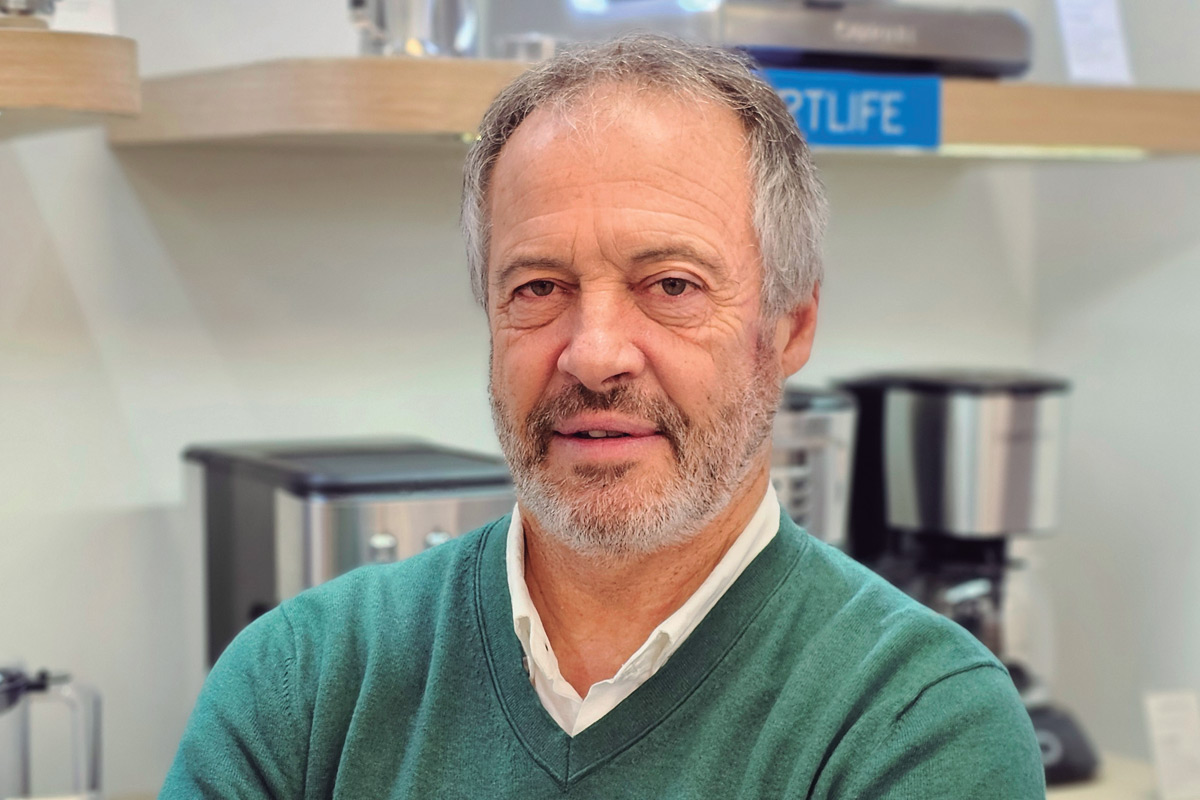

Alejandro Schvartz: “We need the industry to be heard, to think long term and where we want to develop”

With the Director of Visuar we talked about the panorama that the markets present this year, his expectations for the two lines where the company works and the needs of the industry to be able to collaborate with the development of the country.

Por Rodolfo Pollini

Regarding 2023, we are in a time of change, in the economy and in the markets. How did you see, in general and the market, last year?

It was a year in which demand exceeded supply. At the beginning because there were some incentives for consumption, but we all saw that at some point there could be a drop. Starting in June, the supply of parts and finished products began to become very complicated, but all the industries that are involved in household appliances did well, both in terms of sales and inventory. It was a year of growth and if it did not grow more it was due to lack of supply. Due to the deferral of payments abroad, the expectations of a demand that was encouraged by means of payment and inflation, which makes people start spending pesos at any cost, could not be met. It was a combination of things in an acceptable market until the devaluation at the end of the year, which caused a slowdown in consumption and a significant drop in sales from the end of the year and the beginning of January.

Within the white line, how did demand behave qualitatively, both by consumer preferences and by type of products?

The demand was at all levels. In white goods we manufacture and market products from the mid-range up and the reality is that we were never able to supply the channel as we would have liked.

And in small ones?

The same thing happened, the demand was as important in a blender as in a refrigerator, but with a greater supply problem and this has to do with the different types of suppliers. We have an important supplier like Samsung and we have important support despite the many obstacles that existed in the country. The brand supplied us with everything it could, but other suppliers probably did not have as much confidence in what was happening in Argentina and began to restrict supply.

"There is a technological advance from connectivity and what has to do with energy efficiency. The importance of energy saving and climate change is already being established, and this makes companies look for saving methods. Then you have Artificial Intelligence, with equipment that understands uses and customs and makes your life and the use of your time easier"

The market maintains that demand changed in the last Q. In white goods, and taking into account Samsung's positioning from the middle to the top, did the same happen?

It can be measured when demand falls, but as we have always been running from far behind and we could not supply the channel, we do not feel such a significant drop in our sales to retail, but rather in sales to consumers. We did perceive it at the end of December, after that devaluation that we all expected would happen. A devaluation always impacts demand and in this case the devaluation was 120% and with salaries that will take a long time to recover.

You cited consumer incentives through credit, a driver that is always fundamental in this sector. How do you see this issue now, especially thinking about high-priced products that do or do need quotas?

Last year there was an important incentive with the Now 12 and Now 18 plans. That ceased to exist and if they want to implement it the financial cost is so high that it becomes impossible for people to pay. No one will accept paying for a product in 12 installments more than double its cash value. We are in a kind of forced demand. You go out to buy a white goods product that is broken or a house is being built and you can afford it. We came from a process where the replacement of white goods was due to technology and efficiency and that does not happen today. There are price dispersions that people are not clear about, in some things there is inflation in dollars and salaries are outdated due to the increase in prices, although all companies were increasing prices below the devaluation.

Did you notice a great impact on the dollarized input side?

We have dollarized components and others that are not, but together with energy and labor it is a whole mix that is below inflation. Even so, this rearrangement of prices is greater than what occurred in salaries, and there is no financing.

White goods, especially in washing, produce important and more or less frequent technological changes. How do you see that process today?

There is a technological advance from connectivity and what has to do with energy efficiency. The importance of energy saving and climate change is already being established, and this makes companies look for saving methods. Then you have Artificial Intelligence, with equipment that understands uses and customs and makes your life and the use of your time easier. There are washing machines that regulate the use of soap according to the amount of clothes you loaded and refrigerators that allow you to see what is inside and consume less energy at times of lesser use. It is a technological advance that is slowly reaching Argentina, although sometimes not so quickly due to cost reasons, because the high-end market is small.

In the very high range, are there products that do not directly reach the country due to lack of market?

The investment required by any white goods product requires a minimum consumption volume that allows you to see how long it will take to amortize that investment. You are going to sell 100 thousand of a side by side refrigerator in twenty years and no one is going to sustain that platform for twenty years to pay it off. This happens with some very high-end products. In Argentina we have a lot of raw materials, installed capacity, labor and human resources that make it a competitive country in the plastic and metalworking industry, but there are products where investments can be amortized in a considerable period, about 5 years, and can be manufactured here.

Does the industry raise these issues with different governments?

It has always been suggested to governments that we need them to give us conditions to manufacture these products or import them, so that those who can pay for them can have them. This must be allowed with a correct tax policy and, on the other hand, an industry with local development must be supported for products that may have a sufficient market and consumption.

"To raise the problems that have to do with the industry, there would have to be people who understand the industry and not just try to make us competitive with China. We need the Government to listen to the industry to develop quality labor, said Schvartz when analyzing the productive context."

Do you have plans to export taking into account that you have already sent washing machines to Uruguay?

We started exporting to Uruguay and we are analyzing other destinations in the region, but the Argentina has very bad logistics, with costs very high port and internal transport costs. When you manufacture a white goods product with a cost similar to that of another country that exports, such as Mexico, putting that product in San Pablo is much more expensive from Buenos Aires than from Querétaro. There is a logistics infrastructure that the country does not solve, that makes exports more expensive and this is what Governments should be watching.

This implies that if the conditions are met you would have no problems expanding exports and scaling them up.

No. The problem lies outside the industry. If you tour our plant you will see much more efficiency and that it is newer than a plant in Mexico. Why does Mexico export and we don't if we are technologically better? This is said not only by us. We have audits from Korea and they constantly congratulate us. Maybe exporting grains is easy, I don't know, but with the industry it is another issue and I am not comparing with China, or Southeast Asia, I am talking about Mexico and Brazil, our regional competitors. Brazil has many incentives for the industry that Argentina does not have. To raise the problems that have to do with the industry there would have to be people who understand the industry and not just try to make us competitive with China. We need the Government to listen to the industry to develop quality workforce. There are many things that we need and we industrialists can collaborate so that it is not all a matter of immediate costs, that we think in the long term and where we want to develop. The Argentine industry is important and must be given equal conditions to compete.

Let's talk a little about small appliances. Although last year there was also more demand than supply, it is a different sector, due to the way in which demand behaves and the price of the products.

There was more demand than supply, but they are products of faster consumption, almost spontaneous and more so with the accessibility of the quotas. Some are produced in Argentina and others are not, and in these the unsatisfied demand was much greater due to the strict regulations and more deferred payments abroad. Many companies chose to focus on what we manufactured, because sometimes it was easier to get SIRA for the raw materials than for the finished products and we opted for what allowed us to sustain the factory and the people.

Do you see prospects for changes in that?

There was an opening to imports, but the issue of payments is still not resolved. We would have to see what the real demand is for the products that are manufactured and incorporate products that had almost disappeared last year, such as coffee makers and oil-free fryers. Now the portfolio is going to expand and consumption will probably decrease. We will have to see what the total market looks like.

Latest news

Outstanding sector