Consumption in Argentina: 2025 marks the beginning of recovery at different speeds

NielsenIQ (NIQ), líder global en análisis de consumo, dio a conocer los resultados de su informe "Tendencias ARG H1 2025", destacando una serie de mejoras significativas en los indicadores económicos y la confianza del consumidor argentino durante la primera mitad del año.

Nielseniq (NIQ), a global leader in consumption analysis, announced the results of its “ARG H1 2025” tendencies, highlighting a series of significant improvements in economic indicators and the confidence of the Argentine consumer during the first half of the year. This period marks a turning point after consumption experienced Its greatest fall since 2001 last year.

Positive macroeconomic and social panorama:

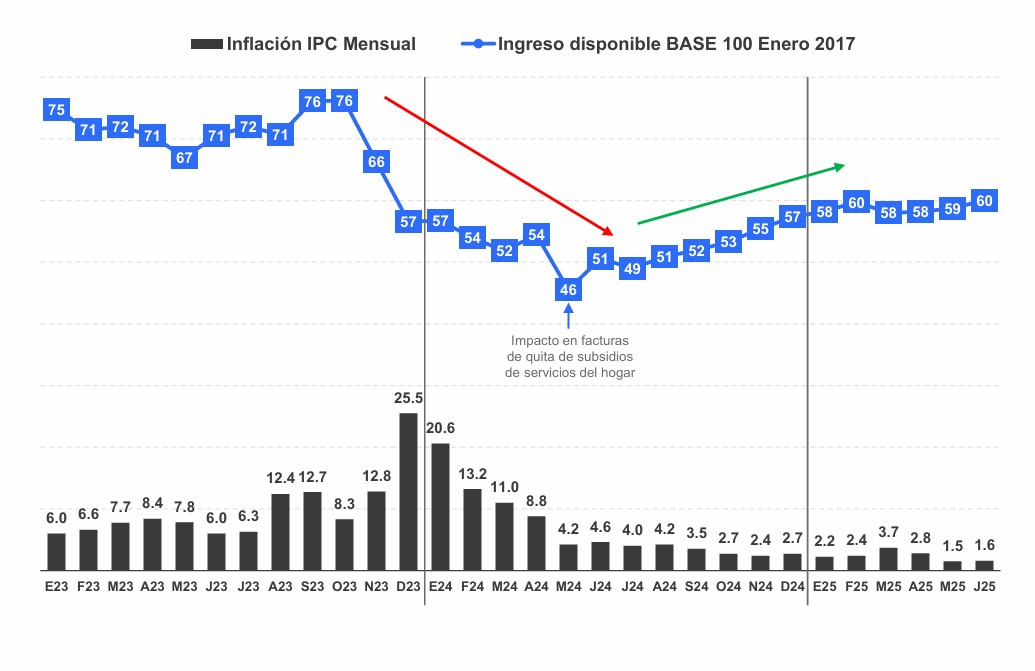

The inflation It has shown a marked deceleration in the first semester of 2025. Both in May and June 2025, the monthly consumer price index (CPI) was of the 1.5%, he lower value since May 2020 (Pandemia) and, excluding that period, the least since January 2018.

The poverty experienced one Fall of more than 20 points, reaching its lower level since the end of 2018, after having affected more than half of the population in early 2024.

He Gross Domestic Product (GDP) It is in the process of recovery, driven by greater agricultural exports, the reactivation of construction and energy, and a moderate recovery of domestic consumption.

The consumer trust has grown considerably, registering a 22% increase in the index compared to June 2024 and keeping in the higher levels of the last 10 years. This improvement is anchored in the inflationary low and also highlights the recovery of the propensity to consume durable and real estate.

Income and consumption recovery, with persistent challenges:

He AVAILABLE INCOME OF HOUSES It is showing a sustained recovery, due to the decrease in inflation, being estimated that at a base of 100 points in January 2017 the year will end in 65 points and by December 2026, in 70 points, reaching levels similar to those of 2023. Regarding June 2024, 9 points were recovered, although 11 points continue under June 2023.

Yes ok All socioeconomic levels (NSE) are recovering income in 2025, this recovery is partial and unequal. While, the NSE high and media are projected to exceed the income levels of 2023, the lows will be lagging behind.

Los Household Services Expenses (Light, water, gas, internet, etc.) continue to gain weight in the family budget, which limits the total recovery of the available income, especially in the most vulnerable sectors. Home services represent a 18.2% of total expenditure in June 2025, an increase of +3.9% compared to June 2023. For consumers, services are the first payment priority (79%).

After the fall in inflation, main concerns for consumers are still low wages and lack of work. The salary and minimal retirements, as well as the feed card, have had increases below inflation in both short and long term.

On the other hand, the higher income sectors, whose registered private salaries manage to achieve inflation, promote the CONSUMPTION OF PRODUCTS AND SERVICES ON FMCG. Low inflation, the stable dollar, the largest financing and the opening of imports paved the land to The recovery of the automotive industry, the properties, the broadly tourism and the durable goods, after years where the sizes of these industries were below 50% vs 2017.

He consumption of mass consumption goods (FMCG), although it will rebound in the following years, it will continue below the levels of 2023. In the first half of 2025, the FMCG basket presents a 1.2% growth, after a 16% contraction in 2024.

NIQ projects that, with the recovery of wages, the consumption of FMCG will grow by volume a 3% vs. 2024, but it will continue well below the levels of 2023, even in 2026.

“We are seeing clear signs of macroeconomic recovery in Argentina, with a notable fall in inflation and a significant reduction in poverty. These indicators are encouraging and reflect an important change in tendency, ”He said Solana Alvarez Fourcade, Directora de Customer Subsequently De Niq Argentina. “However, it is crucial to understand that the recovery of mass consumption advances at a slower speed and that the pressure on the available income of households, especially due to the increase in services in services, presents challenges that companies must monitor closely to adapt their strategies.”

Latest news

Outstanding sector